Blog Post:

For many couples and individuals, the dream of starting a family is a top priority. However, the high costs associated with fertility treatments and adoption can often be a barrier to achieving this dream. As a result, more and more people are turning to alternative methods such as home insemination to conceive. While this may seem like a more affordable option, there are still financial considerations to take into account. In this blog post, we will explore the financial side of home insemination and what you can expect in terms of costs and financial planning.

Understanding the Basics of Home Insemination

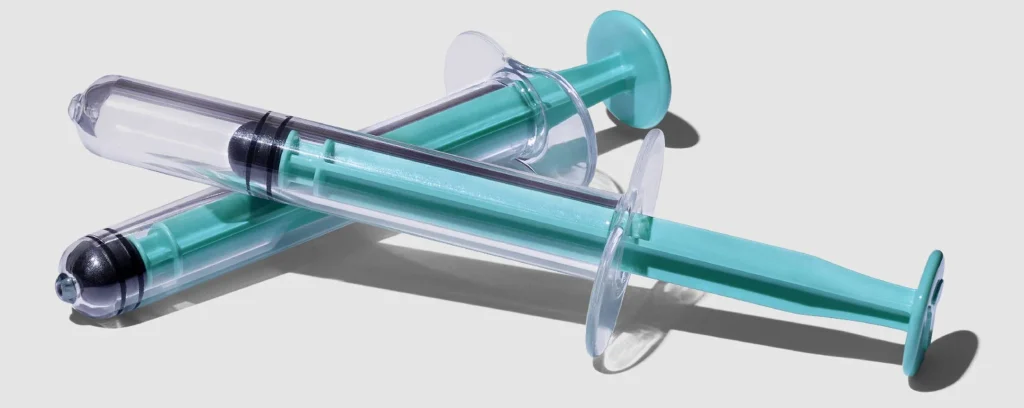

Before diving into the financial aspects, it’s important to have a basic understanding of what home insemination involves. Home insemination is a method of conception where sperm is inserted into the uterus or cervix at home, without the assistance of a medical professional. This can be done using a donor sperm sample or the partner’s sperm, with the help of a syringe or an at-home insemination kit. This method can be a viable option for same-sex couples, single individuals, or heterosexual couples experiencing fertility issues.

The Costs of Home Insemination

One of the main reasons why people turn to home insemination is because of the lower costs compared to other fertility treatments. However, it’s important to note that the costs can vary depending on various factors. Here are some of the potential costs associated with home insemination:

1. Sperm Donor Fees: If you are using a sperm donor, you will need to pay for the donor’s fees, which can range from a few hundred to a few thousand dollars. The cost will depend on whether you are using a known donor or an anonymous donor from a sperm bank.

2. At-Home Insemination Kit: If you opt for an at-home insemination kit, the cost can be anywhere from $50 to $300. These kits typically come with all the necessary supplies, including a syringe and instructions.

3. Fertility Medications: In some cases, fertility medications may be necessary to improve the chances of conception. These medications can range from $50 to $500 per cycle.

4. Medical Expenses: While home insemination can be done without the assistance of a medical professional, some people may opt to have a doctor or midwife present during the process. This can incur additional costs, such as consultation fees and medical supplies.

The Financial Side of Home Insemination: What to Expect

5. Legal Fees: It’s important to have a legal agreement in place with your sperm donor to protect all parties involved. This can involve legal fees, which may vary depending on your location and the complexity of the agreement.

Financial Planning for Home Insemination

As with any major financial decision, it’s crucial to have a solid plan in place before embarking on home insemination. Here are some tips for financial planning for home insemination:

1. Research and Compare Costs: It’s important to do your research and compare costs from different sperm banks and at-home insemination kit providers. This can help you find the best prices and potentially save money.

2. Create a Budget: Once you have a clear understanding of the potential costs, create a budget to ensure you can afford the expenses. Consider all the necessary costs and factor in any additional expenses that may arise.

3. Explore Financing Options: If you are unable to cover the costs upfront, there are financing options available. Some sperm banks offer payment plans, and there are also crowdfunding platforms specifically designed for fertility treatments.

4. Consider Insurance Coverage: While most insurance plans do not cover home insemination, it’s still worth checking to see if your plan offers any coverage for fertility treatments. This can help offset some of the costs.

5. Plan for the Future: Home insemination may not always be successful on the first try, so it’s important to plan for multiple attempts. Consider the costs of each cycle and have a plan in place for how many cycles you are willing to try.

In summary, while home insemination may seem like a more affordable option for conception, there are still financial considerations to take into account. It’s crucial to do your research, create a budget, and explore financing options to ensure you are financially prepared for the process.

SEO Metadata: